XRP has been under renewed selling pressure after falling below the $0.37 price point. In the last week, the cryptocurrency has been stabilizing.

In the previous 24 hours, it dropped about 1.2% of its valuation. The price of XRP decreased by over 8% during the last seven days.

Buyers’ Confidence Continues To Decline

Buyers’ confidence has continued to wane based on how long the token has remained underneath the immediate resistance level. BTC has also dipped below $21,000 and affected the overall market volatility. This has also contributed to the decline of XRP.

The value of XRP can reach the next support level if the price movement continues. However, the desire for XRP has to increase during the upcoming trading days for the bulls to return.

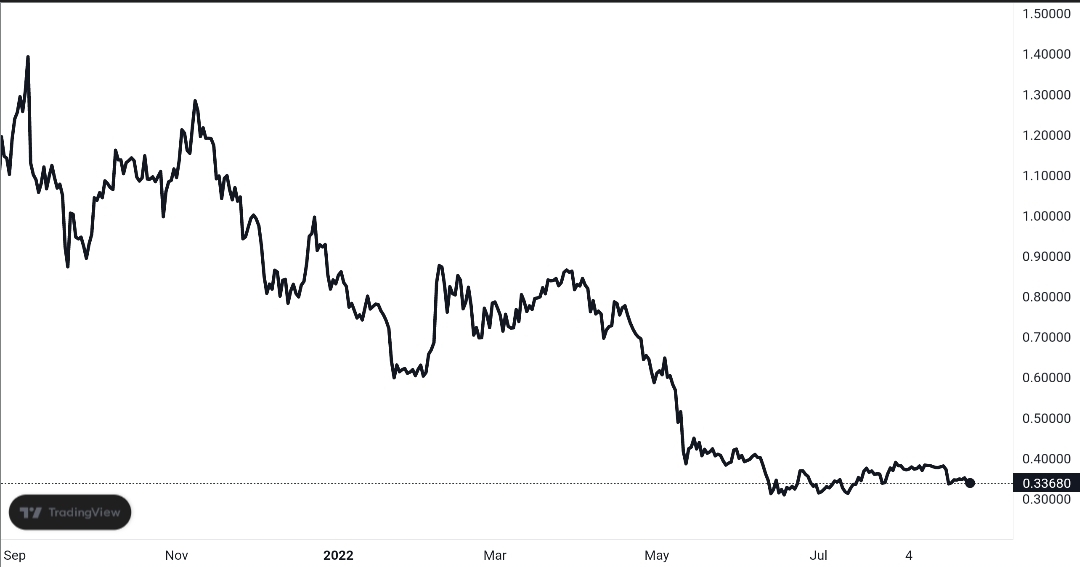

XRP/USD Price Chart Source: TradingView

As of press time, the coin’s price was about $0.34. Meanwhile, XRP was moving so close to the nearest level of support. Hence, it might soon be unable to protect the support at $0.34. Meanwhile, the coin’s subsequent support level is at $0.31.

Also, the upward resistance for XRP is about $0.37; the buyers were recently rebuffed from this price point during trading sessions.

If the token fails to hold above $0.37 during the coming trading sessions, it can drop to about $0.29. Furthermore, XRP’s trading volume has suddenly increased, which shows that the selling pressure has increased.

Selling Pressure Outweighs Buy Pressure

As of the time of writing, the value of the cryptocurrency had dropped to $0.33. The current drop in XRP’s price may result from increased market fluctuations.

Furthermore, the RSI for the token has fallen below the half-line. This means that selling pressure surpasses buying pressure in the market. Hence, more buyers must join the market to push prices up.

Also, the price of XRP has dropped below the 20-SMA, suggesting that the demand for the token has declined. Hence, sellers are currently pushing the price momentum in the market.

Although XRP kept giving off buy signals, MACD revealed that the price velocity and any potential for a reversal were still low. On the half-line, MACD displayed green signal bars.

This is a buy signal indicator. However, the signal bars were getting smaller, which signifies that selling pressure was returning to the market.

In other news, SEC’s lawsuit with Ripple is far from being over soon. Both parties have been battling back and forth in court, with the SEC delaying most of the court proceedings.

More Stories

Interac Investor Review – Is Interac Investor Scam or a Trusted Broker? (Interacinvestor.com)

Koinal Review – Is Koinal Scam or a Trusted Broker? (Koinal.ai)

Fxp360 Review – Is Fxp 360 Scam or a Trusted Broker? (Fxp360.com)